Last Updated on September 21, 2018 by Larious

Zero-fee stock-trading app Robinhood has joined the unicorn club.

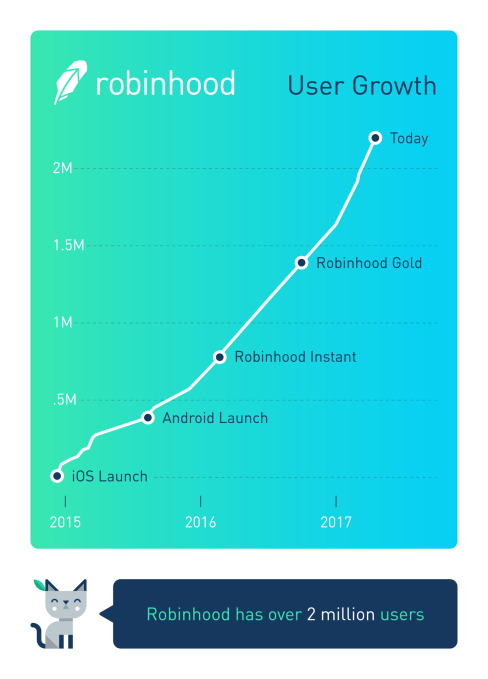

That’s thanks to it reaching 2 million total users, and 17 percent month-over-month growth of its revenue-driving Robinhood Gold subscription product. The startup confirmed to TechCrunch that it’s raised a $110 million Series C at a $1.3 billion valuation led by DST Global, with participation by existing investors NEA, Index Ventures and Ribbit Capital, plus new investors Thrive and Greenoaks.

Today’s announcement confirms TechCrunch’s scoop from last month that Robinhood was raising at $1.3 billion from DST. The 80-person, 4-year-old startup has now pulled in $176 million in total funding.

Table of Contents

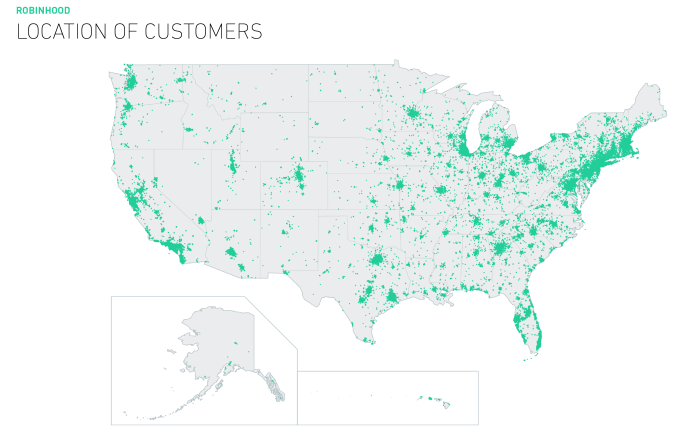

“But how are you going to make money?”

“Our investors are saying ‘we haven’t ever seen a finance company that’s managed to grow like an internet company,’ ” Robinhood co-founder Baiju Bhatt tells me. It’s hit 2 million users, up from 1 million in October, and it’s now adding around 140,000 accounts per month. That’s more accounts than E*TRADE added in all of 2016. [Correction: This story originally said Robinhood has 2 million monthly active users. In fact, it has 2 million active users. Data provider Apptopia estimates Robinhood has 175,000 monthly active users on iOS.]

Other online brokerages like Scottrade and E*TRADE charge $7 to $10 per trade. But by making trading free, Robinhood has saved its users a half billion dollars in commissions on the $50 billion in transactions it’s processed. Bhatt beams, “We pulled a half-billion dollars out of the finance industry and redistributed it to average young Americans. That’s something I’m personally very proud about.”

Robinhood co-founders (from left): Vlad Tenev and Baiju Bhatt

“But ‘how are you going to make money long-term?’ has been a question mark,” Bhatt says. Gold has answered that question.” A Gold subscription lets users borrow up to double the money in their account to trade on margin with leverage, plus skip the three-day waiting period for deposits and make trades instantly. Gold costs $6 to $15 per month for smaller account sizes and less borrowing power, while higher prices up to $200 per month let people borrow up to $50,000.

Robinhood also earns money from rebates its gets for directing its order flow to broker dealers, though, Bhatt insists, “We do not sell data to anyone. We have never sold data to anyone. We just do not do that.” There have been misconceptions that Robinhood sells high-frequency traders its data to help them trade against the startup’s customers. But, Bhatt says, “the rules around this stuff are so tight. We’re not a social media company. If we even step slightly out of line with anything we all go to jail.”

Meanwhile, Robinhood earns money on the interest of cash sitting in its users’ accounts, which could get a boost if the Fed raises the interest rate.

“It’s gone from ‘we want to see where the revenue is going’ to ‘wow that’s really strong, ‘” Bhatt relays.

Robincorn

The revenue momentum and user growth convinced prestigious growth-stage investor DST Global to lead the Series C. Bhatt says that while plenty of its Series B investors asked to be notified when it was raising, DST called Robinhood every month wondering how they could help in a bigger capacity. The level of contact “gives a sense of if they believe in what we’re doing or if they’re following the hype,” Bhatt notes. “They’re also just really smart. They ask questions. They understand what we’re doing.”

The Moscow-based firm led by famous investor Yuri Milner could lend Robinhood international connections as it seeks to grow beyond the U.S.

Expansion abroad has proved trickier than the startup expected. After making in-roads to launching in China through a partnership with Baidu Finance, Robinhood pulled out of the country. “The gist of it is we saw the regulatory climate was changing a little bit there,” Bhatt tells me. The startup clearly didn’t want to get stuck with big expenses and headcount in China, then suddenly not be able to facilitate trades. Progress with strict regulators in Australia has also been slow.

The new cash will help Robinhood double-down in the U.S. The startup says, “we plan on adding and venturing into different products and services, as well as expanding our team here in Palo Alto, hiring for every single department.”

Referralhood

Robinhood is also launching a new referral program today, designed to lure new users but also teach them how to use the app. Bhatt says the company was trying to figure out “how do we build a referral program where when the person signs up, they get a unit of our service for free, like with Uber you get a ride for free so you immediately know what Uber does.”

Now when one user refers someone else who signs up, both get one share of a randomly selected company from a set that includes Facebook, Apple, Rite Aid, Ford and General Electric. “Most people who don’t invest in the stock market, their biggest hangup is they don’t know which stock to buy their very first time,” Bhatt says. But he insists people should dive in to start learning.

Robinhood has plenty to keep learning itself. It needs to keep clamping down on fraud to minimize its costs. It will also have to compete with the big brokerages like Charles Schwab that are responding to its invasion of their market by lowering trading fees. Plus Robinhood must persuade people that it’s safe to trade stocks even if you aren’t rich. That comes down to strong user education in the app about betting real money, and allowing users to trade safer, more diversified ETFs and funds instead of just pouring cash into Snap Inc.

“The finance industry says ‘you need our advice before you start trading.’ That’s bullshit!”

As for broader risks, Bhatt says “the markets have been pretty turbulent for the last six months. I would like to see the markets calm down. If P/E ratios started getting really high that’s something I’d be worried about.” That’s because a P/E ratio bubble could pop, hurting Robinhood users, while a larger crash could slow trading overall. And as with any rising startup, Robinhood has to avoid headcount bloat or getting over extended in markets where it has less inherent advantage.

But if Robinhood can continue to make a historically expensive service free through a lean engineering team instead of a giant brick-and-mortar footprint, it could shake up the finance industry in a big way.

“The real problem is that the finance industry tells consumers ‘you need our advice before you start investing’, or, ‘if you don’t have at least $10,000 you shouldn’t be investing.’ That’s bullshit!” Bhatt rails.

“What they’re actually saying is ‘pay us for advice . . . it’s not profitable for us to do business with you unless you have $10,000 because we have to talk to you on the phone.’ What we’re saying is if you just start investing in stocks you’ve heard of, you’ll be outperforming cash, or what you’d be doing with that money, like spending it on Amazon, on Netflix, on cat socks.”