Last Updated on April 26, 2017 by Larious

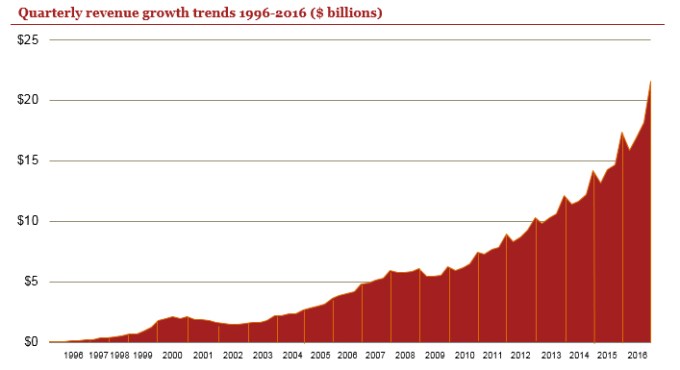

Digital ad revenue grew to $72.5 billion in 2016, up 22 percent from the year before.

That’s according to the latest Internet Advertising Revenue Report from PricewaterhouseCoopers and the Interactive Advertising Bureau (a trade group for online publishers and advertisers).

The report also says that for the first time, mobile ads accounted for more than half of that spending — $36.6 billion, which is 51 percent of the total. Video advertising grew to 53 percent to $9.1 billion, social media spending grew more than 50 percent to $16.3 billion and search grew 19 percent to nearly $35 billion.

The report also looks at digital audio ad revenue for the first time, saying it totaled $1.1 billion in 2016.

“Mobile fueled the internet economy in 2016, with advertisers showing their confidence in digital to achieve their marketing goals,” said IAB CEO Randall Rothenberg in a press release. “This increasing commitment is a reflection of brands’ ongoing marketing shift from ‘mobile-first’ to ‘mobile-only’ in order to keep pace with today’s on-the-go consumers.”

So even if investors remain skeptical about adtech, it looks like the advertisers themselves are still spending aggressively.

But is anyone other than Facebook and Google really benefitting from that growth? Analysts have found that the two giants account for the majority all digital ad spending, and that their dominance is only increasing.

The IAB report doesn’t break out Facebook and Google specifically, but it discusses “revenue concentration” by looking at the top 10 ad sellers and saying they accounted for 73 percent of total revenue — which, apparently, is not all that unusual, since the number has fluctuated between 69 percent and 75 percent over the past decade.

Featured Image: Smartline/Shutterstock